State Bank of India which is one of the biggest and most trusted banks in India, they offer almost all the important banking features to their customers or account holders. IMPS which is the acronym for Immediate Payment Service you can use this feature to transfer funds from your State Bank of India account to any other bank account of your friends and family. But to do so you have to activate your internet banking service if you want to make the IMPS funds transfer online.

I hope you have activated the service but if you have not activated it yet then you can follow this link and read how you can activate internet banking in SBI. You can find the whole procedure in that State Bank of India Guide, in this article of mine I will tell you what to do if your IMPS fund transfer’s status is showing pending even after you have done it.

Sometimes this happens and there are two scenarios and they are, the first one is the amount will be deducted from your bank account but still, you are seeing the status as pending and your receiver has not received it. And the second scenario is the amount has not been deducted from your bank account and the IMPS fund transfer status is pending. This article is based on my personal experience I will share how I got this issue solved let me tell you my story.

My story with experience IMPS fund transfer status.

I had to do payment to one of my service providers I had to pay him for the service I have purchased from him and it was quite urgent and that’s why I used IMPS which normally transfers the funds or money within minutes.

I had added him as my beneficiary in SBI before only so it was not as an issue to add the beneficiary in my internet banking account and transferred funds online.

But as soon as I transferred funds from my account I got a dialog it told me to check status tab after 15 minutes so I checked it after 15 minutes because when I opened my account statement in SBI I did not see any kind of debit in my account.

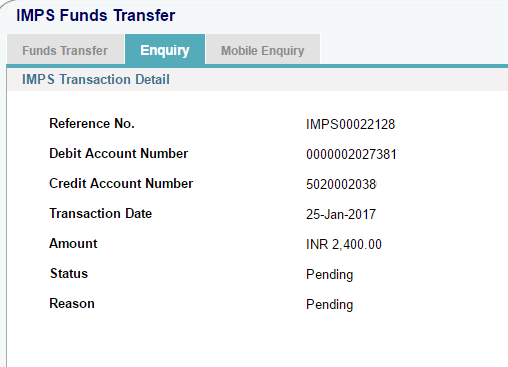

When I checked the IMPS status I saw the IMPS funds transfer status as pending, you can see the screenshot I have attached below.

So what I did next?

Now if you are thinking what I did next then let me tell you, I called SBI customer care center by calling them on their toll-free number1800 425 3800.

I explained them the problem I am facing so they told me that this is because of a technical issue. They took a complaint from me and sent the complaint details by SMS.

How much time did they take to resolve my issue?

While taking the complaint from me they had told me that it will require 10 working days to resolve the issue and their technical team will look after the issue.

I said it this urgent please fix the issue as soon as possible and they said ok we will try our best to fix this as soon as possible. They fixed the issue on the 7th day of my complaint.

Did my IMPS fund transfer succeed after 7th day?

Actually, they did not transfer my money to my service provider, but they fixed the status of transfer it was now showing as failed. I transferred the funds once more and it was transferred within minutes.

The solution for your problem.

I hope you have got the solution for this issue but still let me list down the procedure.

- The first thing you have to do is write down your IMPS Reference number somewhere.

- Call State Bank of India’s customer care on their toll-free number 1800 425 3800.

- Tell them that your IMPS fund transfer is pending.

- They will ask your reference number and account number.

- They will provide you the complaint details.

My Conclusion.

After complaining about the payment status all we can do is wait for the bank to resolve the issue. But I can assure you one thing and that is your money is completely safe with the bank and you will get it back in your bank account or it will be transferred to the receiver.

But do you know you can even transfer money without adding the beneficiary in SBI as well? If you don’t know about that and want to read then you can follow this guide of mine. If you have any kind of comments then you can leave your comment below, I am always happy to hear from you.